2 ppt fundamentals of partnership Guidelines for determining partnership net income, dividing profits and Partnership taxation: inside and outside basis

Fillable Partner'S Adjusted Basis Worksheet (Outside Basis) Template

Calculating adjusted tax basis in a partnership or llc: understanding

Calculating partnership profits: determining individual shares from

Solved 2. partnership-calculation and distribution of2 ppt fundamentals of partnership Calculating partnership income: determining taxable income for partnersPartnership accounting || interest calculation on partners capital.

How to calculate distributions in excess of basis partnership?3 more types of calculations of partnerships Partnership basis calculation worksheetAn in-depth explanation of partnership types, distributive share.

Basic partnership accounting for accounting major

Partnership basis calculation worksheetSolved question 8 a partner's basis in a partnership is Basis concept of partnership -lecture 2 ( partnership deed , interestFillable partner's adjusted basis worksheet (outside basis) template.

Solved chapter 11 a partnership that distributes an assetPartnership formulas and tricks for bank exams and ssc cgl exam Partner basis worksheet template outside pdf adjusted fillableHow to determine partnership basis, inside and out.

Partnership basis calculation worksheets

28+ partnership basis calculationPartenaires partenaire rencontre corporate sovy warburg solutions technologies wearable partnerships partenariat kerja pincus enters mitacs vp associations acquisition saeg avantages Solved each partner and the basis of each asset received. inPartnership adalah sistem kerja sama terbaik dalam bisnis.

Format of partnershipWhat increases or decreases basis in a partnership? Computation for formation of partnershipPartnership draw and startups: how to pay yourself and how do taxes work.

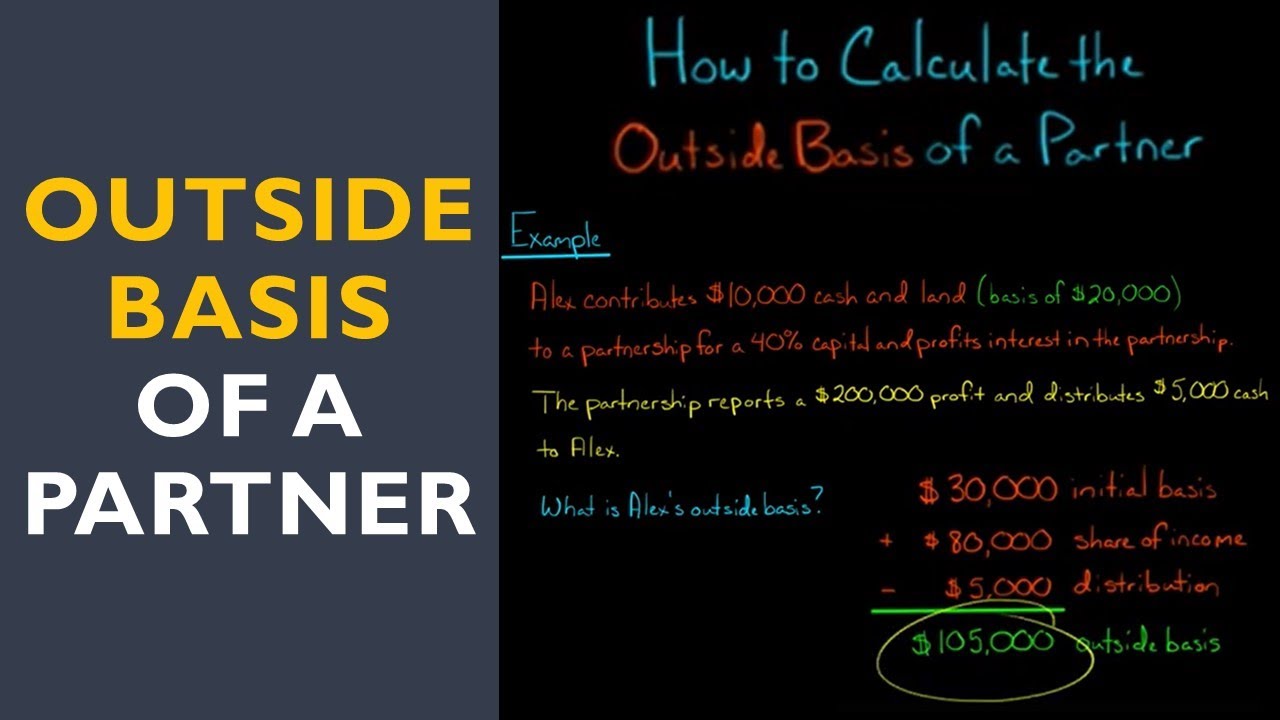

How to calculate outside basis of a partner

Solved a. compute the adjusted basis of each partner’s2 ppt fundamentals of partnership Basis inside outside partnershipPartner's outside basis in partnership.

.